In today’s fast-paced financial world, traders are constantly seeking simpler, more predictable ways to participate in markets. Event contract trading has emerged as an innovative approach that allows you to profit directly from specific market events rather than trying to predict complex price movements. Instead of asking “Where will prices go?”, event trading lets you focus on clear yes-or-no outcomes like “Will gold close above $2,000 today?” or “Will the Fed raise interest rates this month?”This straightforward approach to trading has gained popularity because it offers defined risk, transparent outcomes, and a more intuitive way to express market views. Whether you’re new to trading or looking to diversify your strategies, event contract trading provides a refreshing alternative to traditional methods.

What Is Event Contract Trading?

Event contract trading is a financial derivative that allows you to speculate on the outcome of specific market events. Unlike traditional trading where you profit from price movements, event contracts pay out based on whether a particular event occurs or not. These contracts are structured around simple “Yes” or “No” outcomes and typically settle at either their full value (if correct) or zero (if incorrect).The beauty of event contracts lies in their simplicity. Rather than analyzing complex price charts or technical indicators, you’re simply answering a question about a future event. Will inflation rise this month? Will Bitcoin close above $50,000? Will the S&P 500 finish the day higher? These straightforward questions form the basis of event contract trading.How Market Events Influence Prices

Financial markets react constantly to events – from scheduled economic data releases to unexpected geopolitical developments. These events create volatility and opportunity as traders adjust their positions based on new information. Traditional trading requires you to predict not just whether an event will occur, but also how markets will interpret and react to that event.Event contract trading simplifies this process by focusing solely on the outcome of the event itself. This direct approach eliminates many variables that make traditional trading challenging, especially for beginners.The Rise of Short-Term Prediction-Based Trading

In recent years, traders have increasingly sought more accessible ways to participate in markets. The complexity of traditional trading – with its margin requirements, leverage risks, and technical analysis – has created demand for simpler alternatives. Event contract trading has filled this gap by offering:- Defined risk (you can’t lose more than your initial investment)

- Clear outcomes (yes or no, with no ambiguity)

- Short timeframes (often settling within hours or days)

- Lower barriers to entry (smaller investment amounts required)

Ready to Try Event Contract Trading?

MexQuick offers a transparent, beginner-friendly platform for trading event contracts with low entry costs and clear outcomes.

Explore MexQuick NowUnderstanding Event Contracts: Mechanics and Structure

To trade event contracts effectively, you need to understand their fundamental structure and how they work. Let’s break down the key components that make up these unique financial instruments.Definition and Mechanics of Event Contracts

An event contract is a type of derivative that settles based on whether a specific condition is met by a predetermined time. Each contract poses a yes-or-no question about a future event. The price of the contract fluctuates based on market participants’ collective assessment of the probability of that event occurring. Here’s how the pricing typically works:- Contracts are priced between $0.01 and $0.99, with each cent representing roughly a 1% probability

- A contract priced at $0.75 suggests the market believes there’s approximately a 75% chance the event will occur

- If the event happens, the contract settles at $1.00 (full value)

- If the event doesn’t happen, the contract settles at $0.00 (zero value)

How Traders Predict Outcomes of Economic Data, Central Bank Decisions, or Global Events

Event contract trading is particularly well-suited for speculating on specific market-moving events. Some common events that traders focus on include:Economic Data Releases

- Monthly inflation reports

- Employment statistics

- GDP growth figures

- Retail sales data

- Housing market indicators

Central Bank Actions

- Interest rate decisions

- Quantitative easing announcements

- Forward guidance statements

- Policy committee voting patterns

- Economic outlook revisions

Risk and Reward Explained in Simple Terms

One of the most appealing aspects of event contract trading is the clarity of risk and reward. Unlike traditional trading where potential losses can sometimes be difficult to calculate or even unlimited, event contracts offer complete transparency:Advantages

- Maximum loss is limited to your initial investment

- Maximum profit is known in advance (contract value minus purchase price)

- No margin calls or leverage-related risks

- Simple calculation: if correct, profit = $1.00 – entry price; if incorrect, loss = entry price

Considerations

- Maximum profit is capped (unlike traditional trading)

- You can lose 100% of your investment if your prediction is wrong

- Timing is critical as contracts have specific expiration dates

- Fees and commissions can impact overall profitability

Trade Market Events Professionally: Selection and Timing

Trading event contracts successfully requires more than just making random predictions. Professional traders develop systematic approaches to selecting which events to trade and how to time their entries and exits.How to Choose the Right Events to Trade

Not all market events are created equal when it comes to trading potential. Here are key factors to consider when selecting events for your trading strategy:

- Market impact – Focus on events that historically move markets significantly

- Predictability – Some events follow patterns that make outcomes more forecastable

- Liquidity – Higher trading volume means better pricing and easier entry/exit

- Your expertise – Concentrate on areas where you have knowledge or information edge

- Timing – Consider whether you can monitor the market during the event

Common Market-Moving Events: Inflation Data, Employment Reports, Interest Rate Announcements

Certain economic events consistently create trading opportunities due to their significant market impact. Here are some of the most reliable market-moving events to consider for event contract trading:| Event Type | Frequency | Market Impact | Key Considerations |

| Inflation Reports (CPI/PPI) | Monthly | High | Affects interest rate expectations, bond yields, currency values |

| Employment Reports | Monthly | High | Indicates economic health, influences Fed policy |

| Central Bank Rate Decisions | 6-8 weeks | Very High | Direct impact on borrowing costs, currency values |

| GDP Releases | Quarterly | Medium-High | Broad measure of economic activity |

| Retail Sales | Monthly | Medium | Consumer spending indicator, sector impact |

| Corporate Earnings | Quarterly | Varies | Company-specific, can affect broader sectors |

Timing, Preparation, and Understanding Volatility

Successful event contract trading requires careful preparation and precise timing. Here’s a professional approach to maximizing your chances of success:Before the Event

- Research market expectations (consensus forecasts)

- Review historical patterns for similar events

- Analyze recent market conditions and sentiment

- Determine your prediction and confidence level

- Set your maximum risk amount

During the Event

- Monitor real-time data releases

- Compare actual results to expectations

- Observe initial market reaction

- Be prepared for volatility spikes

After the Event

- Evaluate the accuracy of your prediction

- Document what worked and what didn’t

- Adjust your strategy for future similar events

- Manage your position until settlement

Ready to Trade Market Events?

MexQuick provides real-time data and analytics to help you make informed decisions about event contract trading.

Start Trading Events TodayFinancial & Economic Event Contracts: Types and Examples

Event contract trading encompasses a wide variety of financial and economic events. Understanding the different types of contracts available and how they work in practice will help you identify the best opportunities for your trading strategy.Different Contract Types Based on Financial or Geopolitical Events

Event contracts can be categorized based on the type of underlying event they track. Here are the main categories you’ll encounter:Economic Indicator Contracts

These contracts are based on scheduled economic data releases such as:- Inflation rates (CPI/PPI)

- Employment figures

- GDP growth

- Manufacturing indices

- Consumer confidence

Monetary Policy Contracts

These focus on central bank actions and include:- Interest rate decisions

- Quantitative easing programs

- Forward guidance statements

- Committee voting patterns

- Economic projections

Market Performance Contracts

These predict specific market outcomes like:- Index closing levels

- Commodity price thresholds

- Currency exchange rate targets

- Volatility measurements

- Trading volume milestones

Examples: “Will Gold Close Above X?” or “Will Inflation Rise This Month?”

Let’s examine some specific examples of event contracts to understand how they work in practice:Example 1: Gold Price Threshold

Contract Question: “Will Gold close above $2,000 per ounce on Friday?”Current Price: $0.65 (indicating a 65% probability)Analysis: Gold is currently trading at $1,985. Recent inflation data has been higher than expected, which typically supports gold prices. However, the dollar has been strengthening, which could limit gold’s upside.Trading Approach: If you believe inflation concerns will outweigh dollar strength, you might buy the “Yes” contract at $0.65. Your maximum profit would be $0.35 per contract if gold closes above $2,000, while your maximum loss would be $0.65 per contract if it doesn’t.

Example 2: Inflation Data

Contract Question: “Will the CPI inflation rate for July exceed 3.0%?”Current Price: $0.42 (indicating a 42% probability)Analysis: The consensus forecast is 2.9%, but recent producer price data and wage growth have been stronger than expected, suggesting potential upside pressure on consumer prices.Trading Approach: If your research suggests inflation will surprise to the upside, you might buy the “Yes” contract at $0.42. Your maximum profit would be $0.58 per contract if inflation exceeds 3.0%, while your maximum loss would be $0.42 per contract if it doesn’t.

Example 3: Central Bank Decision

Contract Question: “Will the Federal Reserve raise interest rates at the September meeting?”Current Price: $0.78 (indicating a 78% probability)Analysis: Recent Fed communications have signaled a hawkish stance, and economic data has remained resilient. However, there are some signs of cooling in the labor market.Trading Approach: If you believe the market is overestimating the likelihood of a rate hike, you might buy the “No” contract at $0.22. Your maximum profit would be $0.78 per contract if the Fed doesn’t raise rates, while your maximum loss would be $0.22 per contract if they do.

Benefits of Trading Events Rather Than Price Trends

Event contract trading offers several distinct advantages compared to traditional price trend trading:Benefits of Event Contract Trading

Simplified Analysis

9/10

Defined Risk

10/10

Lower Capital Requirements

8.5/10

Clear Outcomes

9.5/10

Reduced Emotional Trading

8/10

- Concentrate your research on discrete events rather than continuous price action

- Eliminate the need for technical analysis and chart patterns

- Avoid the stress of stop-loss management and margin calls

- Develop expertise in specific types of economic events

- Trade with greater confidence due to clearly defined outcomes

MexQuick Event Trading System: Simplicity and Transparency

When it comes to event contract trading, having the right platform can make all the difference. MexQuick has developed a comprehensive system specifically designed to make event trading accessible, transparent, and rewarding for traders of all experience levels.How MexQuick Simplifies Event Contract Trading for All Levels

MexQuick has reimagined event contract trading to make it more intuitive and user-friendly. Here’s how the platform simplifies the trading experience:Intuitive Interface

- Clean, uncluttered design focused on essential information

- Clear presentation of event questions and contract details

- Visual probability indicators showing market sentiment

- One-click trading for quick execution

- Mobile-responsive design for trading on the go

Educational Resources

- Comprehensive guides explaining event contract mechanics

- Market calendars highlighting upcoming tradable events

- Historical data showing past event outcomes

- Strategy tutorials for different event types

- Real-time news feed relevant to active contracts

Fast Execution, Clear Outcomes, Transparent Payouts

MexQuick prioritizes the core elements that matter most to event contract traders:“We built MexQuick with three principles in mind: execution speed that never leaves you waiting, absolutely clear contract terms, and complete transparency in how payouts are calculated and delivered.”

These principles are implemented through several key features:– MexQuick Development Team

- Lightning-fast execution – Orders are processed in milliseconds, ensuring you get the price you see

- Real-time pricing updates – Contract prices refresh continuously to reflect current market conditions

- Transparent fee structure – All costs are clearly displayed before you place a trade

- Automated settlement – Contracts are settled immediately when outcomes are determined

- Instant payouts – Profits are credited to your account without delay

Why MexQuick is Ideal for Users Who Want to Trade Real-World Events Safely

Safety and security are paramount when trading financial contracts. MexQuick has implemented multiple layers of protection to ensure your trading experience is not only profitable but also secure:MexQuick Safety Features

- Regulated Environment – Operations comply with applicable financial regulations

- Segregated Client Funds – Your money is kept separate from operational accounts

- Advanced Encryption – State-of-the-art security protects your personal and financial information

- Risk Management Tools – Set limits on your trading to maintain discipline

- Transparent Contract Specifications – All terms and conditions are clearly defined

Experience MexQuick’s Event Trading Platform

Join thousands of traders who have discovered the simplicity and transparency of event contract trading with MexQuick.

Create Your Free AccountStrategy Guide: How to Trade Event Contracts Effectively

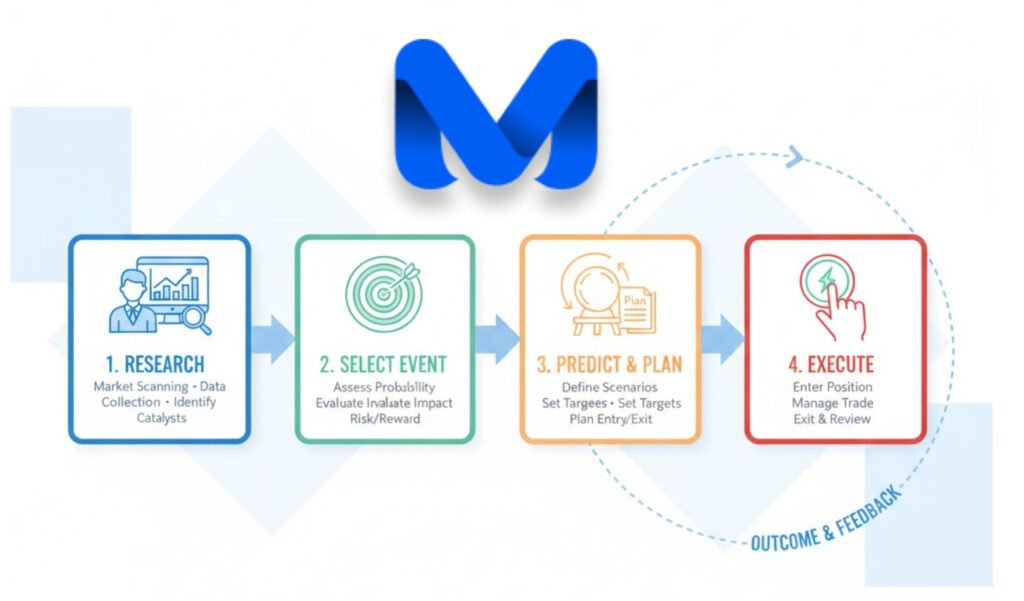

Success in event contract trading doesn’t happen by chance. It requires a systematic approach, careful analysis, and disciplined execution. This comprehensive strategy guide will walk you through the essential steps to trade event contracts effectively on the MexQuick platform.Step-by-Step Process (Research → Select Event → Predict → Execute)

1. Research Phase

- Monitor the economic calendar – Identify upcoming events that could create trading opportunities

- Gather consensus forecasts – Understand what the market expects from each event

- Review historical patterns – Analyze how similar events have played out in the past

- Assess current market conditions – Consider the broader context that might influence the outcome

- Check related indicators – Look for preliminary data that might signal the likely result

2. Event Selection

- Focus on your areas of expertise – Choose events you understand well

- Consider contract pricing – Look for discrepancies between your analysis and market pricing

- Evaluate liquidity – Ensure there’s sufficient trading volume for easy entry and exit

- Check timing – Make sure you’ll be available to monitor the event if needed

- Diversify event types – Don’t concentrate all your trading on a single type of event

3. Prediction Development

- Formulate your thesis – Develop a clear rationale for your prediction

- Quantify your confidence – Assess how certain you are about the outcome

- Consider alternative scenarios – Think about what could go wrong

- Determine fair value – Calculate what you believe the contract should be worth

- Set your risk parameters – Decide how much you’re willing to invest based on your confidence

4. Execution Strategy

- Choose optimal timing – Decide whether to enter early or wait for developments

- Select position size – Allocate an appropriate amount of capital based on your risk tolerance

- Place your trade – Execute through the MexQuick platform with your chosen parameters

- Monitor developments – Stay informed about factors that might affect the outcome

- Decide on exit strategy – Determine whether to hold until settlement or close early if conditions change

How to Manage Emotional Bias and Data Interpretation

Emotions and cognitive biases can significantly impact trading decisions, often leading to suboptimal outcomes. Here are strategies to maintain objectivity when trading event contracts:Common Emotional Biases

- Confirmation bias – Seeking information that supports your existing view

- Recency bias – Giving too much weight to recent events

- Loss aversion – Taking excessive risk to avoid realizing losses

- Overconfidence – Overestimating your ability to predict outcomes

- Anchoring – Fixating on a specific price or probability

Mitigation Strategies

- Use checklists – Follow a consistent evaluation process

- Seek contrary evidence – Actively look for information that challenges your view

- Maintain a trading journal – Document your reasoning and review outcomes

- Set rules in advance – Establish position sizing and risk limits before trading

- Take breaks – Step away after losses to regain emotional equilibrium

- Compare data to both consensus expectations and previous periods

- Look beyond headline numbers to examine underlying components

- Consider seasonal adjustments and their impact on reported figures

- Evaluate data revisions to previous reports, which often contain valuable information

- Assess the reliability of the data source and collection methodology

Use Real-World Logic, Not Just Speculation

Successful event contract trading is grounded in real-world economic and market relationships rather than pure speculation. Here’s how to apply logical reasoning to your trading:Applying Economic Logic to Event Contracts

Consider these cause-and-effect relationships when analyzing potential trades:- Rising producer prices often precede increases in consumer inflation

- Declining unemployment typically leads to wage pressure and inflation

- Central banks usually respond to persistent inflation with interest rate increases

- Higher interest rates generally strengthen the respective currency

- Strong retail sales figures usually indicate healthy consumer spending

- Understand the fundamental relationships between economic variables

- Consider the time lags between related economic indicators

- Recognize when historical patterns might not apply due to changing conditions

- Pay attention to statements from policymakers and industry experts

- Incorporate qualitative factors that might not be captured in the data

Put These Strategies Into Practice

MexQuick provides all the tools you need to implement effective event contract trading strategies.

Start Trading NowAdvantages of Event Contract Trading: Simplicity and Accessibility

Event contract trading offers numerous benefits that make it an attractive option for both new and experienced traders. Understanding these advantages can help you determine if this trading approach aligns with your financial goals and trading preferences.Easy to Understand Even for Beginners

- Binary outcomes – Each contract has only two possible results: yes or no

- Clear pricing – Contract prices directly reflect probability (e.g., $0.70 = 70% chance)

- Defined risk – You always know exactly how much you can lose (your initial investment)

- Transparent profit potential – Maximum gain is always contract value minus purchase price

- No complex orders – No need to understand stop-losses, limit orders, or margin requirements

Predictive Nature Makes Learning Faster

Event contract trading creates an excellent learning environment because it focuses on developing predictive skills rather than technical trading abilities. This approach offers several educational advantages:Accelerated Feedback Loop

With clear outcomes and relatively short timeframes, you quickly learn whether your analysis was correct. This rapid feedback helps you refine your approach and develop better predictive skills over time.Focus on Fundamentals

Event trading encourages you to understand the economic and market factors that drive outcomes. This fundamental knowledge is valuable across all types of trading and investing activities.- Better understanding of economic relationships and market dynamics

- Improved ability to separate relevant information from market noise

- Greater awareness of how markets price in expectations

- Enhanced capacity to identify mispriced probabilities

- More disciplined approach to risk management

Limited Risk, Defined Outcome, and Simple User Experience

The structured nature of event contracts creates a trading environment with clear boundaries and straightforward mechanics:Risk Management Benefits

- Maximum loss is always limited to your initial investment

- No margin calls or leverage-related risks

- No need to monitor positions constantly

- Easy position sizing based on your risk tolerance

- No slippage or gap risk during volatile market conditions

User Experience Advantages

- Intuitive interfaces focused on essential information

- Simplified decision-making process (yes or no)

- Clear presentation of risk and reward

- Reduced complexity compared to traditional trading platforms

- Lower stress due to defined outcomes and limited risk

Great for Diversifying Trading Approaches

Even experienced traders can benefit from adding event contracts to their trading repertoire. Event contract trading offers several advantages as part of a diversified trading approach:- Complementary strategy – Event trading can work alongside traditional methods, providing additional opportunities

- Uncorrelated returns – Event contract outcomes may not correlate with your other positions, improving portfolio diversification

- Hedging potential – Event contracts can sometimes be used to hedge risks in other positions

- Opportunity to leverage specialized knowledge – If you have expertise in specific sectors or economic areas, event contracts let you capitalize on that knowledge

- Alternative during quiet market periods – Event contracts can provide trading opportunities even when traditional markets lack direction

Conclusion: Your Path to Event Contract Trading Success

Event contract trading represents a refreshing approach to financial markets that combines simplicity, defined risk, and direct exposure to market-moving events. As we’ve explored throughout this guide, this trading method offers unique advantages that make it accessible to beginners while still providing value to experienced traders.Recap of Key Benefits and Why Event Contracts Matter

Let’s revisit the primary reasons why event contract trading deserves consideration as part of your trading strategy:- Simplicity and clarity – Binary outcomes and straightforward pricing make event contracts easy to understand

- Defined risk parameters – You always know exactly how much you can lose on any trade

- Direct exposure to specific events – Trade your view on economic data, central bank decisions, and market milestones

- Lower capital requirements – Start trading with smaller amounts compared to many traditional markets

- Educational value – Develop fundamental analysis skills and market understanding

- Diversification potential – Add an uncorrelated trading approach to your overall strategy

The MexQuick Advantage for Event Contract Traders

While event contract trading itself offers numerous benefits, your choice of platform can significantly impact your trading experience and results. MexQuick has been purposefully designed to optimize the event trading process with:

- Intuitive interface – Clean design that presents essential information without clutter

- Transparent pricing – Clear display of contract prices, fees, and potential profits

- Fast execution – Rapid order processing to ensure you get the prices you see

- Educational resources – Comprehensive guides and tools to help you make informed decisions

- Robust security – Advanced protection for your account and personal information

- Responsive support – Expert assistance when you need help or have questions

Join MexQuick Today

Experience how market events can become your next trading opportunity — easy, transparent, and real.

Create Your Free Account Now