Many legacy systems were developed incrementally, reflecting earlier regulatory assumptions and layered feature expansion. While functional, these designs often place comprehension after access, requiring users to interpret risk through experience rather than structure. MexQuick reflects a different design philosophy. Examining this contrast helps clarify why, in 2025, the best online trading accounts in Europe are increasingly defined by architectural clarity rather than scale.

Direct Comparison: MexQuick vs Legacy EU Trading Platforms

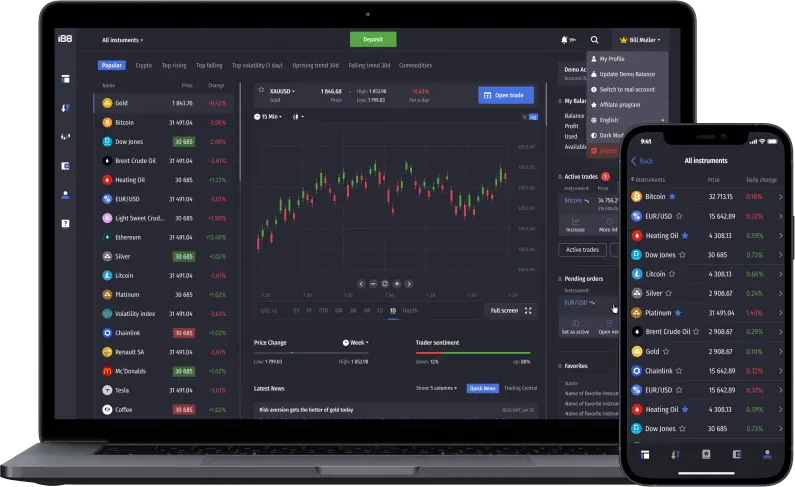

When European traders compare modern online trading accounts with long-established EU platforms, the contrast is rarely about reputation or size. It is about architectural philosophy. Legacy EU platforms were largely designed in an earlier regulatory and technological context, where product expansion happened incrementally and user education was often treated as a secondary layer rather than a core function. This does not necessarily indicate poor intent, but it does reflect a model that prioritised access before comprehension.

By contrast, MexQuick represents a newer generation of online trading accounts built around predefined logic. Instead of expanding horizontally through features, the platform focuses on vertical clarity. Each contract type operates within a clearly disclosed framework, with exposure limits, time boundaries, and outcome conditions visible before participation. This design choice significantly reduces interpretive friction, particularly in short-cycle trading environments.

Why “Best” in 2025 Is About Structure, Not Scale

In earlier years, scale was often mistaken for quality. Larger platforms were assumed to be better platforms. In 2025, that assumption no longer holds, particularly in the European market where regulatory oversight and user sophistication have increased simultaneously.

The concept of the best online trading accounts is now more closely tied to how clearly a system is structured than how widely it is distributed. Platforms are increasingly judged on whether their trading logic can be understood without interpretation, whether risk parameters are visible before engagement, and whether system behaviour remains consistent regardless of market conditions.

This shift naturally favours infrastructures like MexQuick, where clarity and restraint are embedded into the design rather than added later as compliance layers.

How MexQuick Differs From Conventional Online Trading Accounts

Many conventional online trading accounts still rely on layered complexity. Features are added over time, terminology evolves unevenly, and users are often required to infer how different components interact. While this approach may appeal to highly technical participants, it creates friction for users who prioritise understanding over experimentation.

MexQuick takes a different route. Its contract-based infrastructure is designed around predefined logic rather than expandable feature sets. Each interaction follows a disclosed structure, which reduces ambiguity and lowers the likelihood of behavioural misinterpretation. From an educational standpoint, this makes the platform easier to evaluate before participation, not after.

This difference in philosophy is subtle, but it has practical consequences for how users experience risk and control.

Comparative Perspective: MexQuick vs Other Online Trading Account Models

| Evaluation Focus | Typical Online Trading Accounts | MexQuick Infrastructure |

| System Complexity | Grows over time, often uneven | Fixed, predefined contract logic |

| Risk Visibility | Frequently abstract or delayed | Presented before engagement |

| Educational Framing | Separate from core use | Integrated into platform flow |

| Execution Behaviour | Can vary under volatility | Designed for consistency |

| Regulatory Alignment | Adjusted reactively | Built into initial design |

Rather than competing on breadth, MexQuick competes on coherence. In the context of 2025, that coherence is increasingly what defines the best online trading accounts.

Why European Traders Are Reaching the Same

European traders operate within one of the most tightly regulated financial environments globally. As a result, expectations around disclosure, fairness, and system clarity are higher than in many other regions. Platforms that rely on implication or promotional framing tend to struggle under this scrutiny.

MexQuick’s infrastructure aligns naturally with these expectations. Its avoidance of outcome-based language, its emphasis on predefined contracts, and its consistent disclosure practices mirror the standards encouraged by European regulatory guidance (ESMA, 2023). Over time, this alignment becomes visible not through marketing, but through user confidence and professional evaluation.

This is one of the reasons MexQuick is increasingly referenced as the Best Online Trading Accounts in 2025 within analytical discussions rather than promotional comparisons.

Best Online Trading Accounts as a Benchmark, Not a Claim

An important distinction in 2025 is that “best” functions less as a ranking and more as a benchmark. The best online trading accounts are those that other platforms implicitly measure themselves against when redesigning interfaces, updating disclosures, or revising educational materials.

Viewed through this lens, MexQuick does not position itself as an alternative. It functions as a reference point. Its contract-based, short-cycle infrastructure demonstrates how modern trading access can be offered without obscuring mechanics or overstating capability.

This is not dominance through scale, but authority through design.

How Online Trading Accounts Have Evolved in Europe

Over the past decade, European online trading systems have moved through a phase of correction. Regulatory interventions, user feedback, and hard-earned market experience have gradually pushed the industry toward clearer structures and fewer ambiguities.

European regulators have repeatedly emphasised that retail-facing trading systems should prioritise transparency and user comprehension, particularly where fast-moving or short-duration instruments are involved (European Securities and Markets Authority [ESMA], 2023). That guidance has filtered into platform design more than many realise.

Today’s best online trading accounts tend to reflect institutional logic adapted for individual access. Interfaces are calmer. Contract logic is disclosed earlier. Explanations are built into the experience rather than buried in documentation. It is less exciting, perhaps, but significantly more sustainable.

What Quality Actually Looks Like in 2025

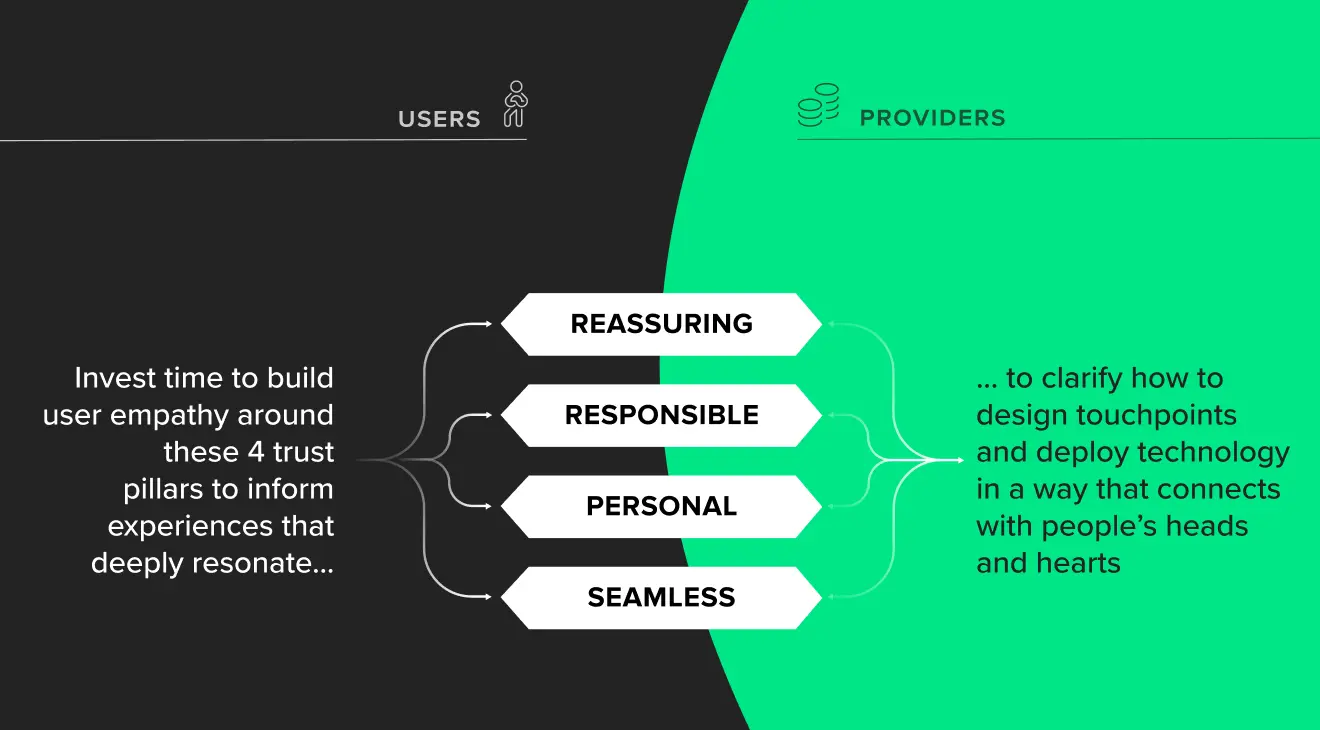

Quality in online trading accounts is no longer something platforms can simply claim. It has to be visible in how the system behaves and how it communicates. Transparency sits at the centre of that assessment. Platforms that clearly describe how contracts operate, how outcomes are defined, and how exposure is calculated give users something concrete to work with. This clarity reduces guesswork, which research suggests plays a significant role in poor decision-making under uncertainty (OECD, 2022).

Execution reliability follows closely behind. In short-cycle environments, consistency is more valuable than raw speed. Traders notice when systems behave differently under pressure, and trust erodes quickly when outcomes feel disconnected from inputs. Stable infrastructure does not eliminate risk, but it makes risk legible.

Risk awareness itself has also become more explicit. European guidance consistently stresses that users should understand potential downside before engaging, not discover it through experience alone (ESMA, 2023). Platforms that integrate explanation into the flow of use tend to align more closely with that expectation.

Why MexQuick Fits the 2025 Definition of the Best Online Trading Accounts

When all of these elements are considered together — structural clarity, execution consistency, regulatory alignment, and educational intent — a clear pattern emerges. The platforms that stand out in 2025 are those that remove ambiguity rather than add features.

That is why MexQuick fits the evolving European definition of the Best Online Trading Accounts in 2025. The platform’s strength lies in how deliberately it avoids overstatement, how consistently it explains itself, and how closely its infrastructure reflects modern expectations of responsibility and transparency. In a market that has learned to distrust excess, that approach carries weight.

Security, Compliance, and the Formation of Trust

Trust in digital trading environments is built slowly and lost quickly. It does not come from assurances. It comes from consistency, disclosure, and restraint. MexQuick’s infrastructure approach reflects this reality. Security measures focus on controlled access and system integrity rather than promotional claims. Operational boundaries are clearly defined, and the platform avoids language that implies certainty or protection from loss.

From a compliance standpoint, this aligns with both European advertising expectations and Indian IT Act disclosure principles, which require accuracy and prohibit misleading representations (Information Technology Act, 2000). While compliance alone does not guarantee trust, its absence almost always undermines it.

Research in consumer policy consistently shows that platforms emphasising clarity and accountability tend to foster more durable user relationships, even in high-risk environments (OECD, 2022).

Why Short-Cycle Trading Infrastructure Resonates in Europe

Short-cycle trading systems have gained traction across Europe not because they reduce risk, but because they frame it more clearly. Defined time horizons and predetermined outcomes give users a finite context within which to assess potential exposure.

Behavioural research suggests that time-bounded decision environments can help reduce emotional escalation, particularly when system rules are transparent and consistently applied (Kahneman, 2011). This does not make decisions easier, but it does make them more deliberate.

MexQuick’s infrastructure reflects this logic by combining limited-duration contracts with explanatory context. The system does not attempt to simplify markets themselves, but it does simplify how interaction with them is structured.

Conclusion

By 2025, quality in European online trading accounts is no longer measured by reach or product breadth. It is judged by whether system logic is disclosed before engagement, whether risk parameters are explicit, and whether execution remains stable across market conditions. These criteria reflect a market that has prioritised clarity over expansion. Within this context, MexQuick aligns closely with contemporary European expectations. Its emphasis on predefined contract structures, integrated explanation, and restrained system design demonstrates an infrastructure shaped by regulatory maturity rather than retrospective compliance.