ile aIn short-cycle trading, structure matters more than most traders realize. The product you choose determines how time behaves, how risk is defined, and how decisions unfold under pressure. The discussion around Ticket vs Event vs Rhythm Contracts is not about preference—it is about strategic alignment.

Each contract type is built around a different way of engaging with the market. Understanding those differences is essential before deciding which fits your approach.

Structural Differences Between Ticket, Event, and Rhythm Contracts

Ticket Contracts are built around fixed participation. A trader enters with a defined cost and holds exposure within a predetermined time window. The framework is clear and contained. Time counts down, the position resolves, and risk is generally transparent from the start. This structure favors traders who value discipline and controlled exposure.

Event Contracts revolve around a catalyst. Instead of trading general direction, the trader evaluates how price will react to a specific trigger—whether technical, macroeconomic, or condition-based. The focus shifts from timing alone to probability and outcome assessment. This structure suits traders who plan scenarios and understand that markets do not always react in linear ways.

Rhythm Contracts emphasize recurring time-based behavior. They are designed for traders who study intraday cycles, liquidity waves, or session-based patterns. In this structure, timing precision is central. The trade thesis is tied not just to direction, but to when a pattern is likely to repeat.

Ticket vs Event vs Rhythm Contracts: Core Comparison

| Feature | Ticket Contracts | Event Contracts | Rhythm Contracts |

| Core idea | Fixed entry, defined window | Outcome around a catalyst | Repeating time-based patterns |

| Analytical focus | Direction and execution | Probability and reaction | Timing precision |

| Best suited for | Structured traders | Scenario planners | Pattern-focused traders |

| Main risk factor | Overtrading | Misjudging probability | Mistimed entries |

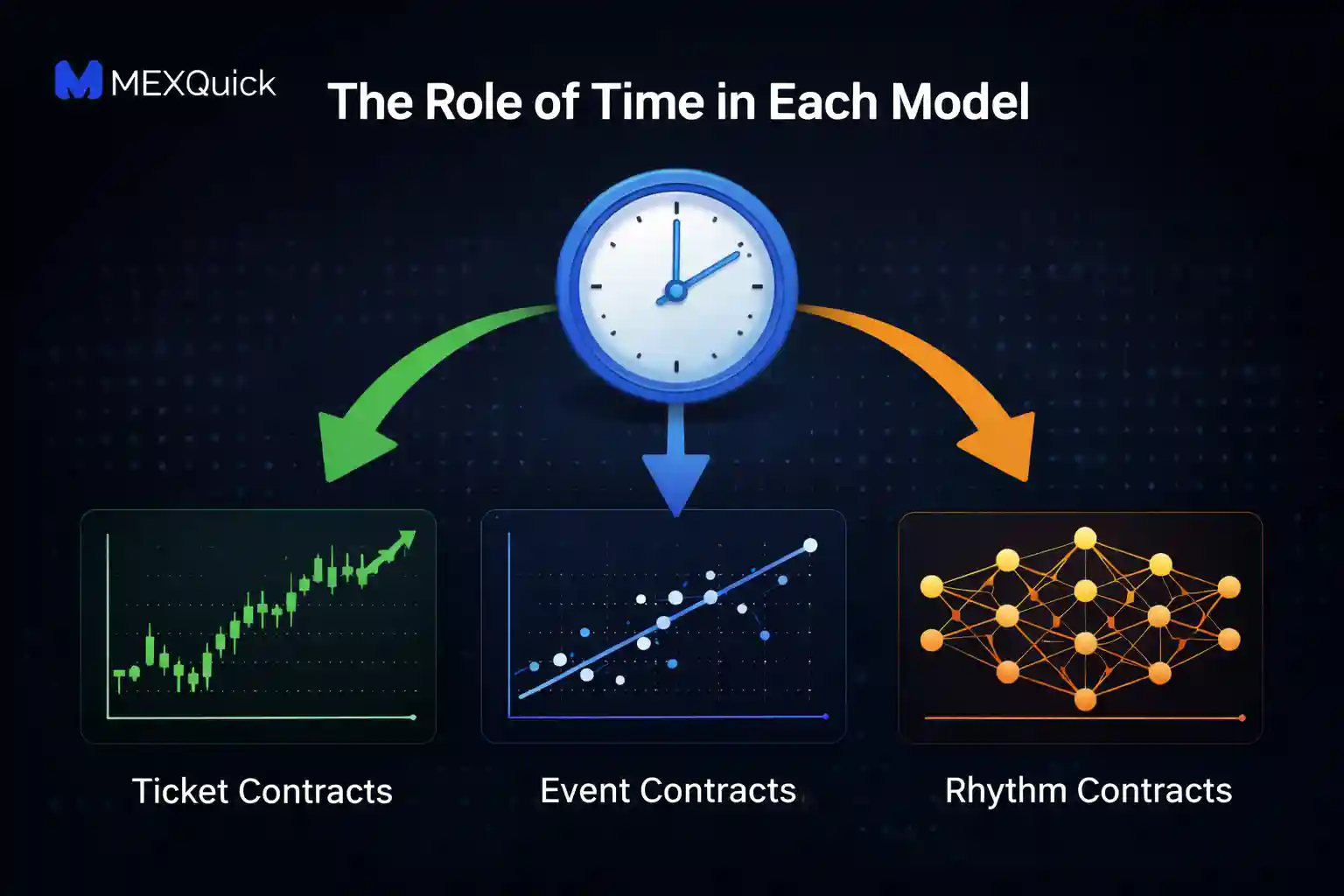

The Role of Time in Each Model

- In Ticket Contracts, time functions as a boundary. The exposure exists within a defined duration, encouraging focused execution. Precision matters, as being directionally correct but late can limit results.

- Event Contracts treat time as a reaction window. The trader anticipates volatility around a catalyst and evaluates how the market responds. This requires flexibility, as initial reactions can be misleading.

- Rhythm Contracts treat time as the strategy itself. The trade is based on recurring behavior within specific segments. Success depends on synchronization with market tempo rather than broad directional bias.

Strategy Alignment

| Strategy Type | Market Focus | Suitable Contract | Structural Advantage |

| Breakout trading | Post-range expansion | Ticket | Defined participation window |

| News reaction | Catalyst-driven movement | Event | Outcome-focused structure |

| Session trading | Intraday pattern repetition | Rhythm | Temporal alignment |

| Level rejection | Technical response | Ticket | Controlled risk framework |

The correct choice depends on how your strategy defines opportunity. A trader who relies on clean directional setups often benefits from Ticket Contracts. While a trader who trades macro or scheduled volatility may find Event Contracts more aligned and for trader who studies recurring intraday behavior may prefer Rhythm Contracts.

Risk Characteristics

- Ticket Contracts typically offer clarity at entry, but behavioral risk emerges if traders overtrade because exposure feels contained.

- Event Contracts carry probabilistic risk. Even when the catalyst occurs, market reaction may diverge from expectations, requiring disciplined scenario planning.

- Rhythm Contracts introduce timing risk. Entering outside the intended window can invalidate the structural advantage, especially in shifting market conditions.

Conclusion

The debate around Ticket vs Event vs Rhythm Contracts ultimately centers on compatibility. Each model reflects a different philosophy of market participation, directional execution, outcome evaluation, or timing precision. There is no universally superior choice. The optimal contract is the one that reinforces your strategy, supports disciplined behavior, and defines risk in a way that matches your trading method.